Frequently Asked Questions

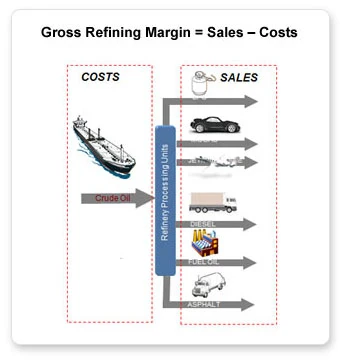

Some often question why Gross Refining Margin (GRM) does not increase as finished product prices rise. GRM may even turn negative despite an upward trend in the retail price. The reason for this is because GRM is the difference between finished product sales and costs of refining operations. Crude purchases are a major cost incurred by refineries while the selling of finished products amount to revenue for refineries. Gains or losses of refineries result from changes in both factors. In other words, GRM cannot be determined by absolute finished product prices alone.

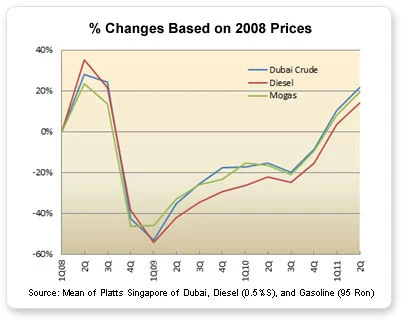

Crude and finished product prices do not necessarily move up or down in the same proportion or at the same time. In cases where an increase in finished product prices is higher than those in crude prices, we have higher revenues than costs and this leads to higher GRM. In contrast, if finished product prices increase to a lesser extent than crude prices do, GRM decreases even though finished product prices have gone up.

Different market factors affect crude and finished product prices.

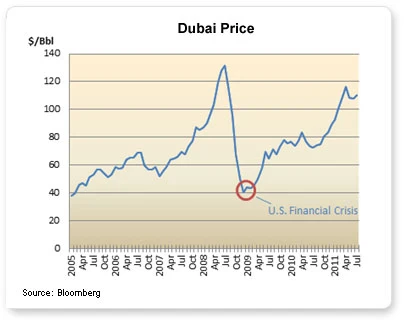

Crude prices, in general, are determined by crude oil demands from refineries across the world and crude oil supply capacity of oil exporting countries. When crude demand exceeds supply capacity, the crude market is tightened which leads to higher crude prices. For example, the recent unrest in North Africa and Middle East has caused certain exporting countries (e.g. Libya) to discontinue crude exports. On the other hand, if crude demand drops below crude oil supply capacity it will result in a long crude market and drive down crude prices as we experienced during the 2009 U.S. sub-prime crisis which triggered global recession and ultimately a drastic decline in energy demands.

Finished product prices share similar characteristics but are driven by finished product demands and refinery capacity in countries or a region. Refinery capacity can change: increasing or decreasing due to maintenance, interruptions, new builds or plant shutdowns. Product demand varies by market segments such as motor gasoline for personal transportation, diesel for commercial transportation, or fuel oils for industrial use. Hence, overall finished product price volatility is a mix of the product price movements in different market segments.

In the normal course of the refinery business, the raw material acquisition process starts about one or two months ahead of the refining process to allow time for crude transportation, refining operations, and supply and distribution operations to service stations and ultimately motorists. There are also compulsory stock requirements (CSO), which subject to change per DOEB announcement, for refineries to maintain crude stock no less than 4% of production volumes and finished product stock no less than 1% of sales volumes (rates are effective from 1 May 2020 per DOEB announcement as of 13 April 2020). Products are produced by refining raw materials or crude which is acquired and maintained in our stock. The delta between crude prices at the time we purchased the crude a month ago and current crude prices is considered a stock gain or loss.

During an upward oil price trend, the cost of refining crude in our stock is lower than current crude prices which results in a stock gain and consequently higher Gross Refining Margins (GRM). On the other hand, stock loss and low or negative GRM occurs when crude cost for the stock used for refining are higher than current crude prices.

For example, unusual crude price movement occurred in 2008 when the Dubai price moved around $90 per barrel at the beginning of the year, and then rallied up to $140 per barrel in July which led to a stock gain and strong GRM in the first half of the year. After that, the U.S. sub-prime crisis drove down the Dubai price drastically to $40 per barrel at year-end. This resulted in a stock loss and negative GRM in the second half and brought the full year results to a stock loss and negative GRM as the positive results in the first half were partly offset by negative second half results.

Though oil price volatility is a key factor of stock gain or loss, we consider stock gain or loss as part of our normal operations which is not controllable as crude prices are set on a free market basis. Over the long term, stock gains and losses offset each other or are netted to an insignificant value. Our stocks are maintained to the lowest possible level with the objective to minimize inventory holding expenses.

The company does not expect to engage in hedging oil prices or margins because hedging transactions can be of a speculative nature and incur additional transaction costs.

Oil is a commodity product in a market which is highly competitive. Pricing policy or production and sale strategies of a market player can impact the overall market as the other players may consequently make price adjustments in order to maintain their competitiveness. Therefore, the to-be reference oil price should be determined by demand and supply capabilities in free markets within a given proximity. This approach which is similar to what is done with agricultural goods such as fruit reference prices at Tai market or rice reference prices at Kumnun Song market.

The three major oil trading regions are North America, Europe and Asia Pacific. The AP trading hub is in Singapore as it is the biggest exporting country in the region. Singapore reference prices are not refined product prices set by Singapore government or refineries. They essentially are the prices of products which are traded in Singapore by oil traders in the region.

Thailand is in the AP region and located near Singapore; therefore, it is logical that Singapore oil prices are used as reference prices. Singapore oil prices not only reflect equilibrium prices of free markets in the region but also globally align with the other regional trading hubs.

Rather than using Singapore reference prices, we could set our own ex-refinery gate prices in Thailand; however, this could create imbalances in both domestic oil demand and supply. For instance, if we set our prices lower than Singapore prices, local refineries may increase exports to make more profits and the local market is then short of products. In contrast, if our own prices are set higher than Singapore prices, traders may import products to sell in the local market and compete with local refineries. It might adversely impact the local labor market and growth of domestic refineries.

In addition, using Singapore reference prices will drive local refineries to enhance potential, efficiencies, and competitive edges so that they can compete at the regional or global level and this will eventually benefit local consumers and the Thai economy.

When crude prices rise, local retail refined products normally move up in line with crude prices although not at the same time or proportion. In some situations, the government may intervene in the market to control retail prices at lower-than-market prices by providing subsidies such as capping Bio-diesel at 30 Baht per liter in 1H2011.

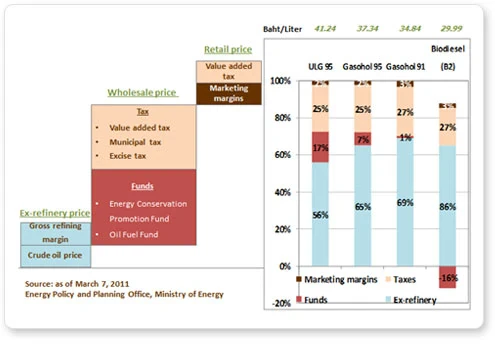

On top of crude prices, there are other components which contribute to retail prices as explained in the below pricing formula.

Retail price = Wholesale Price (*) + Marketing Margin + Value Added Tax

(*) Wholesale price = Ex-refinery Gate Price + Oil Fund Contribution + Excise Tax + Municipal Tax + Value Added Tax

Ex-refinery gate prices are set based on Singapore reference prices which are driven by free markets in the Asia Pacific region. Other than that, the other components, including the Energy Conservation Promotion Fund, Oil Fuel Fund, and taxes are controlled and determined by government agencies. In other words, local oil traders cannot set retail prices by themselves. Local oil traders' earnings from retail sales revenues are only part of the ex-refinery gate price and marketing margin while the remaining components are revenue to the government.

The retail pricing structure on March 7, 2011 illustrates that ex-refinery gate prices and marketing margins (so-called selling base prices) account for 60-70% of retail prices. That is, motorists pay for refined products at prices higher than selling base prices by 30-40% which essentially are taxes and fund contributions.

For gasoline 95 in the above data set, motorists pay 41.24 Baht for a liter of gasoline of which about 24 Baht is for gasoline itself and the rest are taxes and contributions to the government. This is the reason why retail oil prices are higher than selling base oil prices.