Restructuring Plan (Tender Offer)

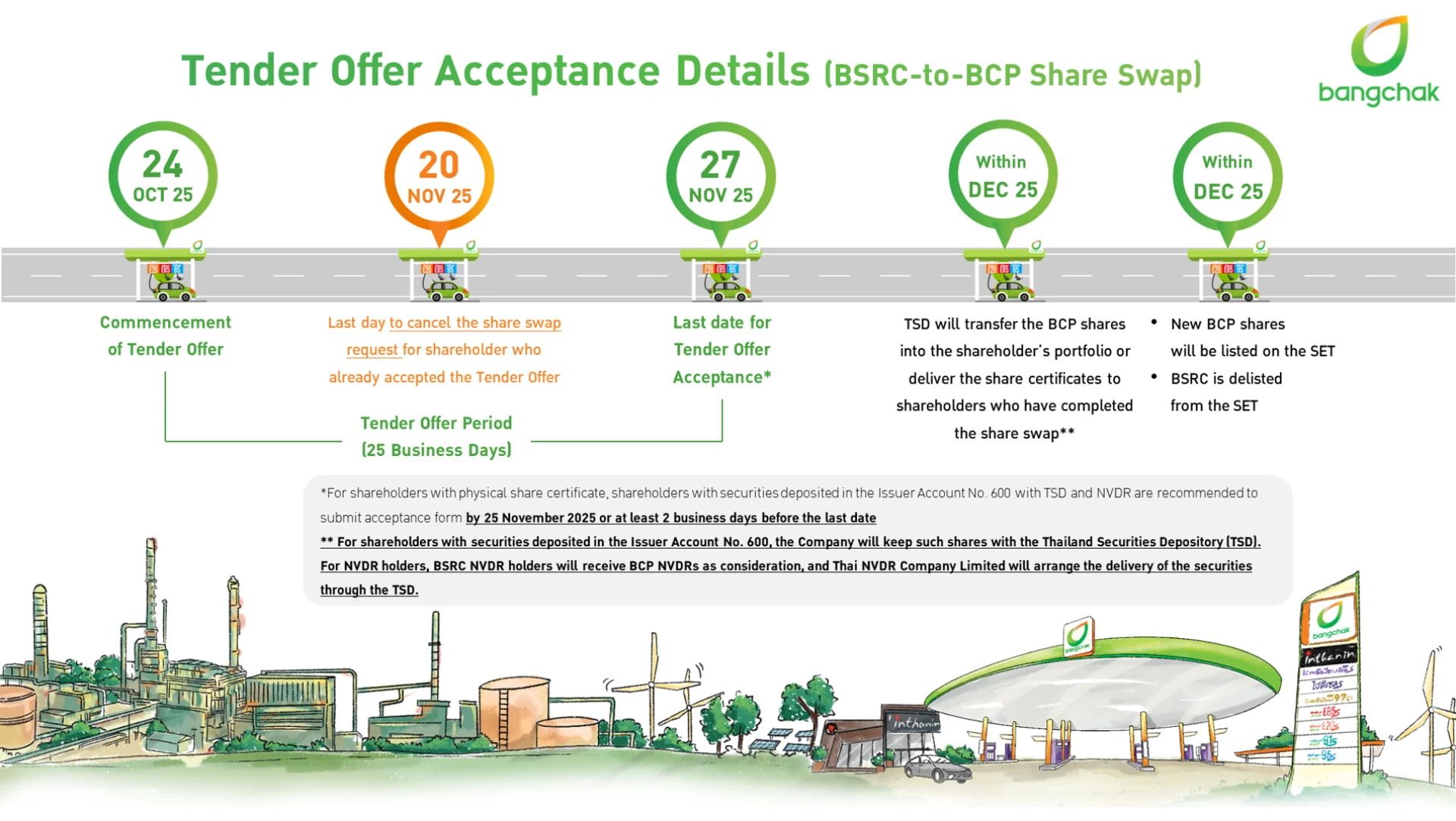

BCP is undergoing a restructuring of its shareholding and management structure by acquiring all of the ordinary shares of Bangchak Sriracha Public Company Limited (BSRC) from other shareholders of BSRC through a tender offer. BSRC shareholders will receive newly issued ordinary shares of BCP as payment for the tender offer, at a swap ratio of 6.5 BSRC ordinary shares per 1 BCP ordinary shares. The share swap period will take place from October 24 to November 27, 2025 (on business days and during business hours only).

It is highly recommended that you complete the share swap within the specified timeframe.

This share swap will not be conducted automatically. Shareholders must initiate the process themselves, as it is their individual right, and the company is unable to act on their behalf. We apologize for any inconvenience this may cause.

Explore more

Tender Offer Process

Case 1 : Holding Shares with a Securities Company (Scripless)

- Complete the E-Tender process via the KKPS website Click (For more details, Click)

- Contact Bualuang Securities at 02-618-1111 or your account manager to request and proceed the share transfer.

** Once the process is complete, you can check your investment portfolio. If BSRC shares no longer appear in your portfolio, the share swap has been successfully completed

- Complete the E-Tender process via KKPS website. (For more details, Click)

- Transfer securities via App Streaming, My Service. (For more details, Click)

** Once the process is complete, you can check your investment portfolio. If BSRC shares no longer appear in your portfolio, the share swap has been successfully completed

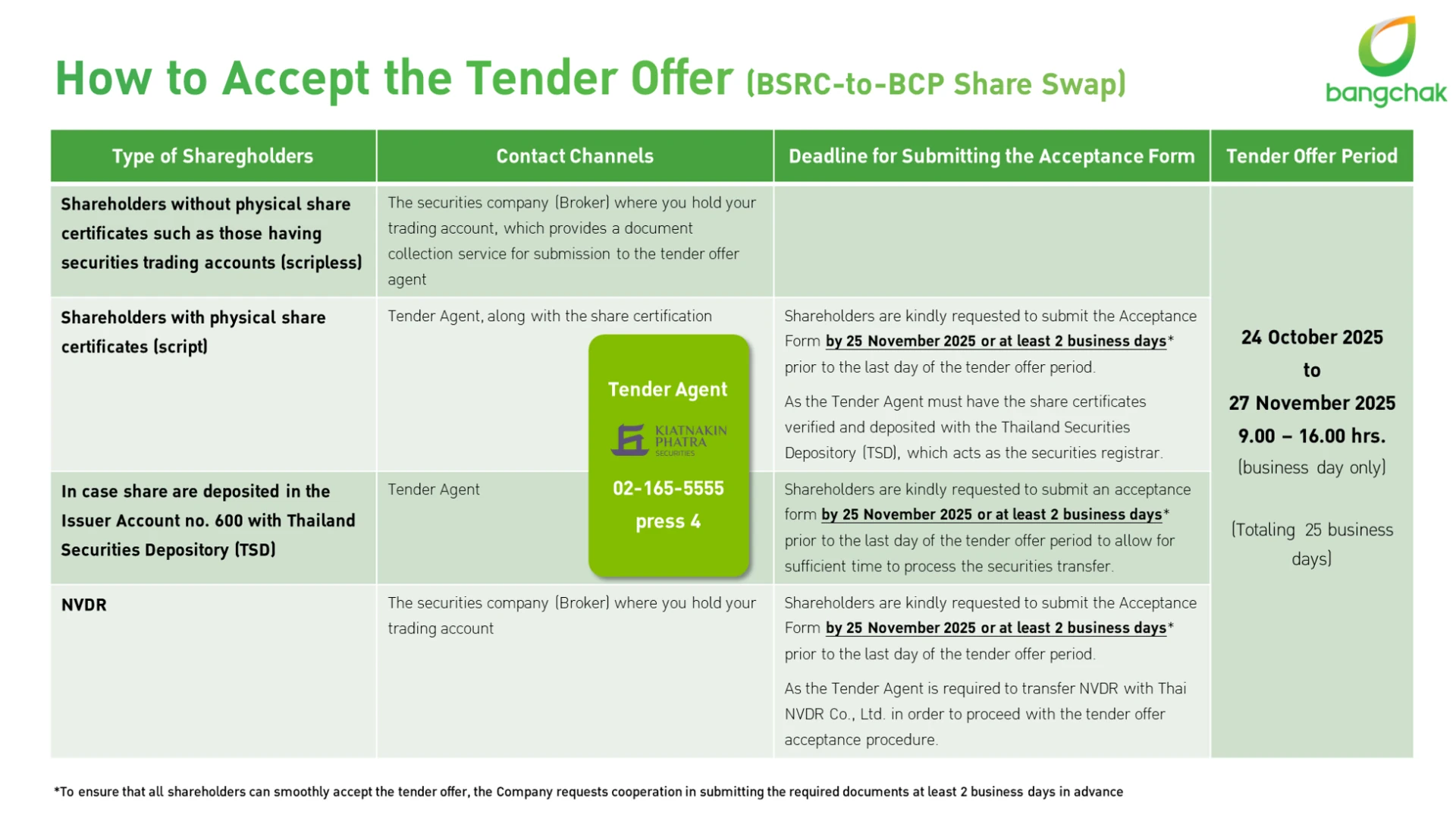

Contact your securities company or your account manager to inquire about the tender offer acceptance

- Complete the Tender Offer Acceptance Form Click or proceed with the E-Tender via KKPS website Click (for more details, Click)

- Inform your securities company or account manager of your intent to accept the tender offer.

- Submit the required documents or follow the procedures as advised by your securities company.

** Once the process is complete, you can check your investment portfolio. If BSRC shares no longer appear in your portfolio, the share swap has been successfully completed

Contact the securities company (broker) managing your account, or Kiatnakin Phatra Securities 02-165-5555 press 4 (Tender Agent) and follow the steps to accept the Tender offer and submit required document to Kiatnakin Phatra Securities

Case 2 : Other Holding Formats

Please contact Kiatnakin Phatra Securities Public Company Limited at 02-165-5555 press 4 (Tender Agent) to express your intention to accept the tender offer

Shareholders are requested to submit the tender offer acceptance form by November 25, 2025, or at least two business days before the last day of the offer period. This is necessary as the Tender Agent must verify and deposit the share certificates with the Thailand Securities Depository, the securities registrar.

Steps to Accept the Offer

- Step 1: Complete the Tender Offer Acceptance Form. Click (For more details, Click).

- Step 2: Sign the endorsement on the back of the share certificate.

- Step 3: Submit the acceptance form, share certificate, and required supporting documents to KKPS.

Required Supporting Documents

For Thai Individual Shareholders

- A copy of a valid Thai national ID card, signed for certification.

- If submitting a copy of a government officer’s ID, attach a certified copy of the house registration showing the matching address and name.

For Thai Corporate Shareholders

- A certified copy of the company registration certificate or equivalent legal document.

- A certified copy of the valid Thai national ID card of the authorized signatory.

Contact Kiatnakin Phatra Securities 02-165-5555 press 4 (Tender Agent) and follow the steps to accept the Tender offer and submit required document to Kiatnakin Phatra Securities

Related Documents

Registration Statement for Securities Offering together with Tender Offer for the Securities (Form 69/247-1)

Important Forms (Enclosure)

7.2 Form for Tender Offer Acceptance of Bangchak Sriracha Public Company Limited and Share Subscription of Bangchak Corporation Public Company Limited

7.3 Power of Attorney for Tender Offer Acceptance and Share Subscription

7.4 FATCA/CRS Self-Certification Form for Individual Customer

7.5 FATCA/CRS Self-Certification Form for Entity/Juristic Person

7.6 Application for Withdrawing from the Participant Account

8.2 Form for Tender Offer Acceptance of Bangchak Sriracha Public Company Limited and Share Subscription of Bangchak Corporation Public Company Limited – NVDR

8.3 Power of Attorney for Tender Offer Acceptance and Share Subscription - NVDR

10 Application for Amending Securities Holder Records

11 Application for Securities Transfer between the issuer account and the depository participant account

12 Share Cost Declaration Form (for foreign juristic persons not conducting business in Thailand)

FAQ

Following the acquisition of BSRC, the Company successfully realized over THB 6 billion in value creation from synergy recognition in 2024. This transaction is a strategic move aimed at restructuring the internal business operations within the Bangchak Group. The restructuring will enhance competitiveness and operational efficiency, enabling the Group to respond more effectively to business opportunities and strengthen its financial performance. Moreover, the restructuring will streamline the Group’s business structure, reduce complexity in shareholding arrangements, improve operational agility, and eliminate redundant processes. It will also reduce the burden of dual listing obligations between BCP and BSRC. This initiative forms part of the Company’s strategy to transition toward a Single Listed Entity model in the refining and marketing businesses, allowing for seamless and unlimited synergy realization in the future.

- For the opportunity to access a financially robust and diversified business group: BCP has total assets of over THB 300 billion and a diversified investment portfolio with multiple growth drivers that support sustainable expansion.

- For greater trading liquidity and a larger market capitalization: BCP shares offer significantly higher trading liquidity and a larger market capitalization than BSRC shares. Furthermore, BCP has a broader investor base both domestically and internationally, which is expected to allow its share price to better reflect its fundamental value.

- For the opportunity to receive dividend and other shareholder benefits: BCP has a consistent history of dividend payments and a higher historical Total Shareholder Returns (TSR) compared to BSRC shares.

The tender offer period is expected to commence from October 24, 2025, to November 27, 2025, (a total of 25 business days), from 9:00 a.m. to 4:00 p.m.

The decision to participate in the share swap is entirely personal rights and must be initiated by the shareholder, allowing them to exercise full control over their investment decisions. The process of accepting the tender offer by shareholders is carried out in accordance with the relevant securities laws and regulations.

- BSRC shares will continue to be traded as usual – from now (including during BCP’s tender offer period) until the day prior to the delisting of BSRC from the Stock Exchange of Thailand (SET). SET will announce the delisting date in advance via its official website for BSRC shareholders’ information. The delisting is expected to take place after the completion of the tender offer period, tentatively around December 2025.

- Before the delisting date, BSRC shareholders may choose either to sell their shares through the SET or to accept the tender offer.

The last day on which investors can purchase BSRC shares and remain eligible to participate in the tender offer is November 25, 2025, in line with the payment and share delivery timeline set by the Stock Exchange of Thailand, which follows the T+2 settlement cycle (2 business days after the trading date). Investors who purchase BSRC shares must submit the tender offer acceptance form along with all required supporting documents to tender agent by November 27, 2025, before 4:00 p.m.

Yes, they can. The final decision to accept or reject the tender offer rests solely with each individual BSRC shareholder. If any BSRC shareholder decides not to respond to the tender offer or fails to submit the acceptance form within the specified period, they will remain a shareholder of BSRC.

BSRC shareholders who do not wish to accept the tender offer should consider the following potential impacts:

- BSRC shares will no longer be tradable on the Stock Exchange of Thailand, resulting in the absence of a market reference price and significantly reduced liquidity for BSRC shares.

- Individual shareholders of BSRC will no longer be eligible for the personal income tax exemption on capital gains derived from the sale of shares. In addition, both individual and corporate shareholders will no longer be exempt from stamp duty on the transfer of BSRC shares.

- BSRC shareholders may miss the opportunity to hold BCP shares through the share swap. BCP is a leading company with solid financial fundamentals and a track record of stable and sustainable performance.

- BSRC shareholders will receive significantly less information than they currently do as shareholders of a listed company. Nevertheless, BSRC shareholders will continue to have access to disclosures required under the Public Limited Companies Act as well as information that BCP may disclose from time to time, given that BSRC will remain a subsidiary of BCP under applicable securities laws.

- Once BSRC is delisted from the SET, BSRC will no longer be obligated to submit documents to the SET as a listed company. However, as a public limited company, BSRC remains responsible for submitting certain documents, such as annual financial statements and annual report, to the Ministry of Commerce in accordance with the Public Limited Companies Act.

- Furthermore, if after the completion of the tender offer, the minority shareholders (excluding the BCP group) collectively hold no more than 5.0% of BSRC’s total voting rights, BSRC will no longer be obligated to prepare and submit financial and operational reports—such as the One Report and quarterly financial statements—as a company issuing shares and warrants (if any) to the SEC Office under relevant securities laws. This would also terminate BSRC’s obligations under the Securities and Exchange Act, including those related to significant transactions and related party transactions.

- However, since BSRC still has outstanding debt instruments issued and offered to specific investors, with transfer restrictions registered with the SEC, BSRC will continue to have obligations as a debt issuer. These include preparing and submitting financial and operational reports—such as annual financial statements, semi-annual financial statements, annual reports on key financial ratios, and reports on the use of proceeds from the debt offering—to the SEC.

Shareholders may sell their BSRC shares through an Over-the-Counter (OTC) method, which refers to securities trading conducted outside the Stock Exchange of Thailand (SET). Such transactions are carried out directly between counterparties and may have low liquidity (meaning shares may not be easily or quickly traded), high price volatility (as there is no official market reference price), and may also subject to capital gains tax on profits from the sale of shares, which individual investors must pay when trading outside the Stock Exchange.

- BSRC shareholders who tender their ordinary shares to BCP will receive newly issued ordinary shares of BCP at a ratio of 1 BCP share for every 6.50 BSRC shares. (the “share swap ratio”)

- Shareholders may only tender BSRC shares in whole numbers. Fractional shares (e.g. 0.5 shares) will not be accepted.

- After aggregating the total number of BSRC ordinary shares submitted by each shareholder for the tender offer, as specified in the acceptance form, the number of BCP shares to be received will be calculated based on the predetermined exchange ratio. If the calculation results in fractional BCP shares (“fractional shares”), such fractions will be disregarded. BCP will compensate BSRC shareholders who have expressed their intention to sell shares with a cash payment in Thai Baht, rounded to two decimal places. The compensation amount for the disregarded fractional shares will be calculated based on the exchange ratio, equivalent to the price at which BCP issues new ordinary shares in exchange for BSRC shares under this restructuring process, which is set at THB 37.25 per share (“Compensation Price per Share”). For rounding to two decimal places, if the third decimal is equal to or greater than THB 0.005, the amount will be rounded up; if less than THB 0.005, it will be rounded down (“Fractional Share Compensation”).

- Example of fractional share compensation calculation: A BSRC shareholder indicates in the acceptance form that they wish to exchange a total of 10 BSRC common shares.

- Based on the exchange ratio, the shareholder will receive 1 BCP common share and a fractional share of 0.53846153846154, which will be disregarded. BCP will compensate the shareholder for the fractional share according to the specified criteria.

- Multiplying the fractional share of 0.53846153846154 by the Compensation Price per Share of THB 37.25 results in THB 20.0576923076924. Since the third decimal is greater than or equal to THB 0.005, the amount will be rounded up.

- Therefore, BCP will pay fractional share compensation of THB 20.06 to this BSRC shareholder.

- This fractional share compensation policy also applies to BSRC shareholders who hold NVDRs through Thai NVDR Company Limited, including cases where Thai NVDR Company Limited submits the acceptance form on behalf of all remaining NVDR holders.

- If a BSRC shareholder indicates an intention to sell shares by specifying fewer than 7 BSRC shares in any individual acceptance form, the securities tender agent reserves the right to reject such acceptance form and any related documents. This is because the number of BSRC shares does not meet the minimum threshold required under the share swap ratio. Accordingly, no BSRC shares submitted in such cases will be exchanged for BCP shares, and no fractional share compensation will be paid in cash for those shares.

- If, on the date that Thai NVDR Company Limited submits the tender offer acceptance for BSRC shares on behalf of NVDR holders, an NVDR holder holds fewer than 7 BSRC shares through Thai NVDR Company Limited, such NVDR holder will not be allocated BCP newly issued shares through NVDR, as the number of BSRC shares held via NVDR is below the minimum exchange ratio. In such case, the tender offer agent will return the BSRC shares to the respective NVDR holder, and no share exchange of BSRC shares held through NVDR for BCP shares through NVDR will take place.

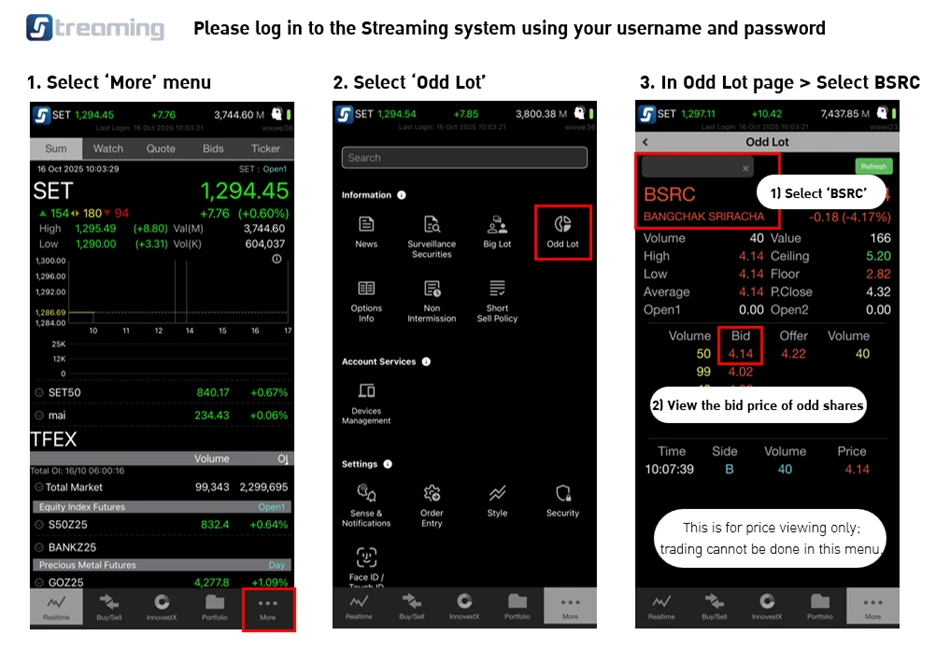

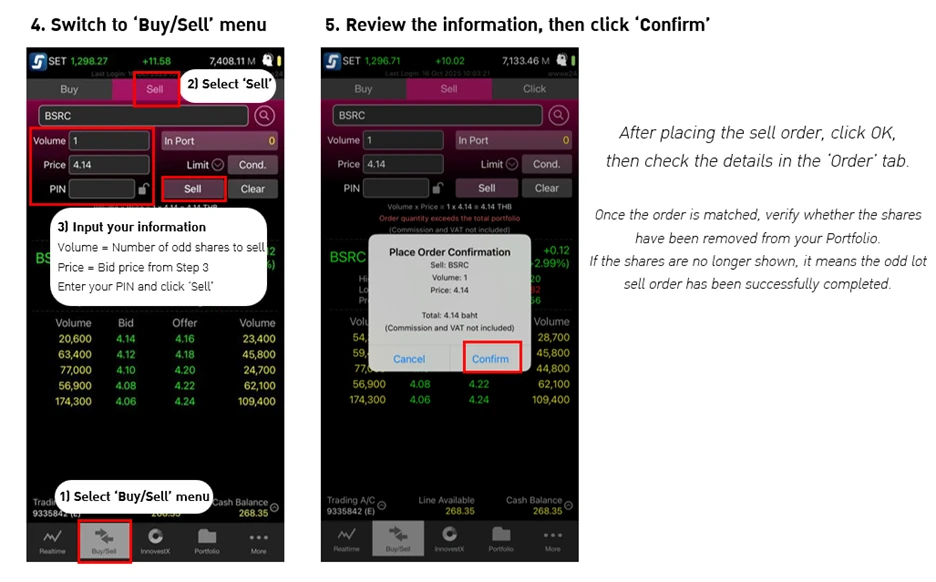

- BSRC Shareholders may contact their brokerage company to inquire about procedures for managing fractional shares, e.g. sell BSRC shares through the Odd Lot board (ceasing to be a BSRC shareholder) or purchase additional BSRC shares through the SET or the Odd Lot board to reach the minimum threshold required for participating in the tender offer and share swap with BCP.

- Example of the procedure for selling BSRC odd lots

- The determination of the swap ratio between BCP and BSRC was primarily based on the fair value of both companies. Various relevant factors were considered including financial position and operating performance, market price of the common shares, valuation using the Adjusted Book Value Approach and valuation using the Discounted Cash Flow (DCF) Approach.

- In addition, both BCP and BSRC appointed independent financial advisors to provide opinions on the restructuring plan and the proposed swap ratio. These opinions have been submitted to shareholders for their consideration. The Boards of Directors of both BCP and BSRC have reviewed and concluded that the proposed swap ratio is reasonable and fair to the shareholders of both companies.

- Please consider the opinion of the independent financial advisor. [Form 69/247-1 Enclosure 5 (Click)

- If shareholders transfer their BSRC shares from their securities brokerage account to the tender offer agent, transfer fees may apply, subject to the terms and conditions of each brokerage firm. BSRC shareholders can contact their securities company to inquire about the share transfer fee rate.

- If shareholders authorize a representative to submit the acceptance form and related documents on their behalf, a stamp duty fee of 10–30 baht will be required to affix to the power of attorney document.

- When BSRC shareholders exchange their shares for BCP shares, it is considered a sale of shares with compensation received in the form of BCP shares. If shareholders gain profit from the sale, the following tax obligations apply:

- For shareholders that are companies or juristic partnerships established under Thai law, or foreign entities operating in Thailand: The profit from the sale of shares must be included as income for corporate income tax calculation. The company is not responsible for withholding income tax.

- For shareholders that are foreign entities not operating in Thailand: The company is required to withhold tax at a rate of 15%, unless exempted under a double taxation agreement with Thailand. The company will calculate and support the withholding tax payment. shareholders are requested to provide cost information (via the “Confirmation of Securities Cost Form,” Enclosure 12) to ensure accurate tax calculation.

- For other types of shareholders not covered in (1) and (2): They are either exempt from income tax on capital gains from share sales or not subject to income tax, and the company is not responsible for withholding tax.

- Shareholders who purchase BSRC shares on or before November 25, 2025 (the last trading day to be eligible for the exchange into BCP’s newly issued shares) may submit an additional acceptance form, provided that the form is submitted by November 27, 2025, before 4:00 p.m., indicating only the number of BSRC shares you wish to exchange further without the need to cancel any previously submitted form. Please refer to Form 69/247-1, Section 2, Item 1.1.9 (Click) and Section 2, Item 1.3.1 (Click) for further details.

- Share Aggregation Criteria in the Case of Multiple Acceptance Forms Submitted by BSRC Shareholders:

- If a BSRC shareholder submits multiple acceptance forms (including those submitted via the online E-Tender system) and/or through multiple channels prior to the share swap, the securities tender agent will aggregate the total number of BSRC ordinary shares indicated across all acceptance forms and online submissions under the name of the same shareholder. (Each acceptance form must specify a minimum of 7 BSRC shares.) The aggregated total will then be used to calculate the number of BCP shares to be received, based on the applicable swap ratio and the rounding and fractional share compensation rules. The securities tender agent will then deliver the BCP newly issued common shares to the shareholder in proportion to the number of BSRC shares submitted and according to the delivery method specified in each acceptance form.

- If additional BCP shares are allocated as a result of aggregating multiple acceptance forms and/or online submissions, the shareholder agrees that the securities tender agent may exercise discretion in allocating such BCP shares to any one of the shareholder’s securities accounts as specified in the acceptance forms, as deemed appropriate by the tender agent.

- For the payment of fractional share compensation, the shareholder agrees that the securities tender agent may exercise discretion in selecting a single delivery channel for the compensation payment, as deemed appropriate by the tender agent.

- In cases where the same BSRC shareholder submits multiple acceptance forms, including via the online channel, the securities tender agent will aggregate the number of shares indicated across all acceptance forms submitted under the name of the same shareholder. The aggregation will be based on the following identification criteria:

- For Thai individual shareholders: Full name and national ID number.

- For non-Thai individual shareholders: Full name and passport number.

- For Thai juristic persons: Entity name and taxpayer identification number.

-

For non-Thai juristic persons: Entity name and either the taxpayer identification number (for entities operating in Thailand) or the company registration number (for entities not operating in Thailand).

Note: For BSRC shareholders who are private funds, the shareholder must provide additional identification details, including full name and either the taxpayer identification number, company registration number, or passport number, as applicable.

- The securities tender agent reserves the right to aggregate the number of BSRC shares indicated across all acceptance forms, including those submitted via the online channel, by the same shareholder for the purpose of calculating the number of BCP newly issued common shares to be received, based on the applicable swap ratio and the rounding and fractional share compensation rules. This aggregation will only be applied if the shareholder has submitted all acceptance forms and supporting documents with accurate, complete, and consistent information across all submissions.

- This share aggregation condition also applies to shareholders who hold NVDRs representing BSRC common shares through Thai NVDR Company Limited, including cases where Thai NVDR Company Limited submits the acceptance form on behalf of all remaining NVDR holders.

- Shareholders may revoke their intention to swap shares between 9:00 a.m. and 4:00 p.m. on any business day from October 24, 2025, to November 20, 2025, or within the first 20 business days of the tender offer period.

- To cancel, the tender offer participant must complete the cancellation request form for the intention to sell BSRC shares and subscribe for newly issued BCP shares, and attach the following documents: (1) proof of receipt of documents, (2) identification documents, (3) power of attorney (if unable to submit in person), and (4) for shareholders who deposit securities with the Thailand Securities Depository under the Issuer Account (Member No. 600), the TSD-403 form must be submitted. (Click)

- Please refer to Form 69/247-1, Section 2, Item 1.5 for further details. (Click)

Shareholders may contact the Thailand Securities Depository (TSD) at +66 2 009 9999 (press 0, then 1) to verify their shareholding details. TSD can provide guidance for further inquiries regarding the procedures, steps, or applicable fees related to this matter.

- Shareholders may choose to transfer their BSRC shares to a single securities company in advance to facilitate a consolidated transaction. If they do not wish to consolidate their shares, they may submit separate acceptance forms through each securities company.

- The securities tender agent will aggregate the total number of BSRC shares indicated across all acceptance forms submitted by the shareholder and calculate the number of BCP newly issued shares to be received based on the applicable swap ratio and rounding rules. (Note: Each acceptance form must specify no fewer than 7 BSRC shares.) However, the tender agent reserves the right to aggregate the number of shares only if all acceptance forms and supporting documents submitted contain accurate, complete, and consistent information—such as full name and national ID number—across all documents. Please refer to Form 69/247-1, Section 2, Item 1.3 for further details. (Click)

- Share Aggregation Criteria in the Case of Multiple Acceptance Forms Submitted by BSRC Shareholders: The details are as specified in FAQ No.15.

- For ordinary shareholders: submit power of attorney with a stamp duty of THB 10-30 (as applicable), along with certified copies of identification documents of both the grantor and the grantee, as specified in Form 69/247-1, Section 2, Item 1.3.

- For NVDR holders: shareholders may authorize a representative to submit the acceptance form and related documents on their behalf. Shareholders must complete the power of attorney with a stamp duty of THB 10-30 (as applicable), along with certified copies of identification documents of both the grantor and the grantee, as specified in Form 69/247-1, Section 2, Item 1.3.

- However, if the shareholder submits the acceptance form through the securities company where their BSRC shares are held, and authorizes the securities company to forward the documents directly to the tender agent, a power of attorney is not required in such cases.

- Please refer to Form 69/247-1, Section 2, Item 1.3 for further details. (Click)

In case of the BSRC shareholder has passed away with an executor appointment, but the share transfer is not yet completed

- The executor can proceed with the tender acceptance without completing the share transfer.

In case of the shareholder has passed away with an executor appointment, but a physical share certificate is lost

- The executor must file a report of the lost share certificate and request a new one from the TSD. The process of issuing a new certificate may take about two weeks. Therefore, the executor should contact the TSD at least two weeks before the tender offer acceptance deadline.

In case of the shareholder has passed away without an executor appointment, and the share transfer is not yet completed

- The heir must complete the appointment of an executor during the tender offer acceptance period. If appointing an executor is not possible (e.g., in the absence of a will), all heirs can agree to proceed with the tender acceptance.

In case of the shareholder has passed away without an executor appointment, and a physical share certificate is lost

- The heir must appoint an executor during the tender offer acceptance period. After the appointment, the executor must file a report for the lost share certificate and request a new one from the TSD. The process of issuing a new certificate may take about two weeks, so it is recommended to do this in advance, at least two weeks before the acceptance deadline.

In case of the shareholder has passed away with an endorsed share certificate

- Share transfer must be completed according to the procedures set by TSD. This includes completing the Application for the Administration of Estate (TSD-103) (Click) and submitting all necessary supporting documents to the TSD.

- Further details on the Application for the Administration of Estate (TSD-103) and the required supporting documents can be found on the SET's website by searching for "Application for the Administration of Estate (TSD-103)".

- Each securities company will confirm the transaction completion according to its own procedures. Some may send confirmation via email or provide a physical confirmation document. Additionally, the securities tender agent will issue a Confirmation Letter to BSRC shareholders after the share swap is completed.

- Shareholders may also check their investment portfolio directly. If BSRC shares no longer appear in the portfolio, it indicates that the share swap has been successfully completed.

- BSRC shareholders who participate in the share swap will receive BCP shares and will be able to trade them starting in December 2025. The SET will announce the official trading start date for the newly issued BCP shares on its website.

For foreign individuals and foreign juristic persons, the securities tender agent will issue a cheque for the fractional share compensation and send it via registered mail to the address specified in the tender offer acceptance form.